U.S. stocks traded mixed this morning, with the Dow Jones index gaining more than 100 points on Thursday. Following the market opening Thursday, the Dow traded up 0.34% to 37,880.89 while the NASDAQ fell 0.16% to 15,658.94. The S&P 500…

In the wake of co-founder Changpeng Zhao’s departure, Binance, the world’s leading cryptocurrency exchange, has secured a pivotal regulatory license in Dubai. What Happened: Binance was awarded its Virtual Asset Service Provider (VASP) license after Zhao gave up his voting…

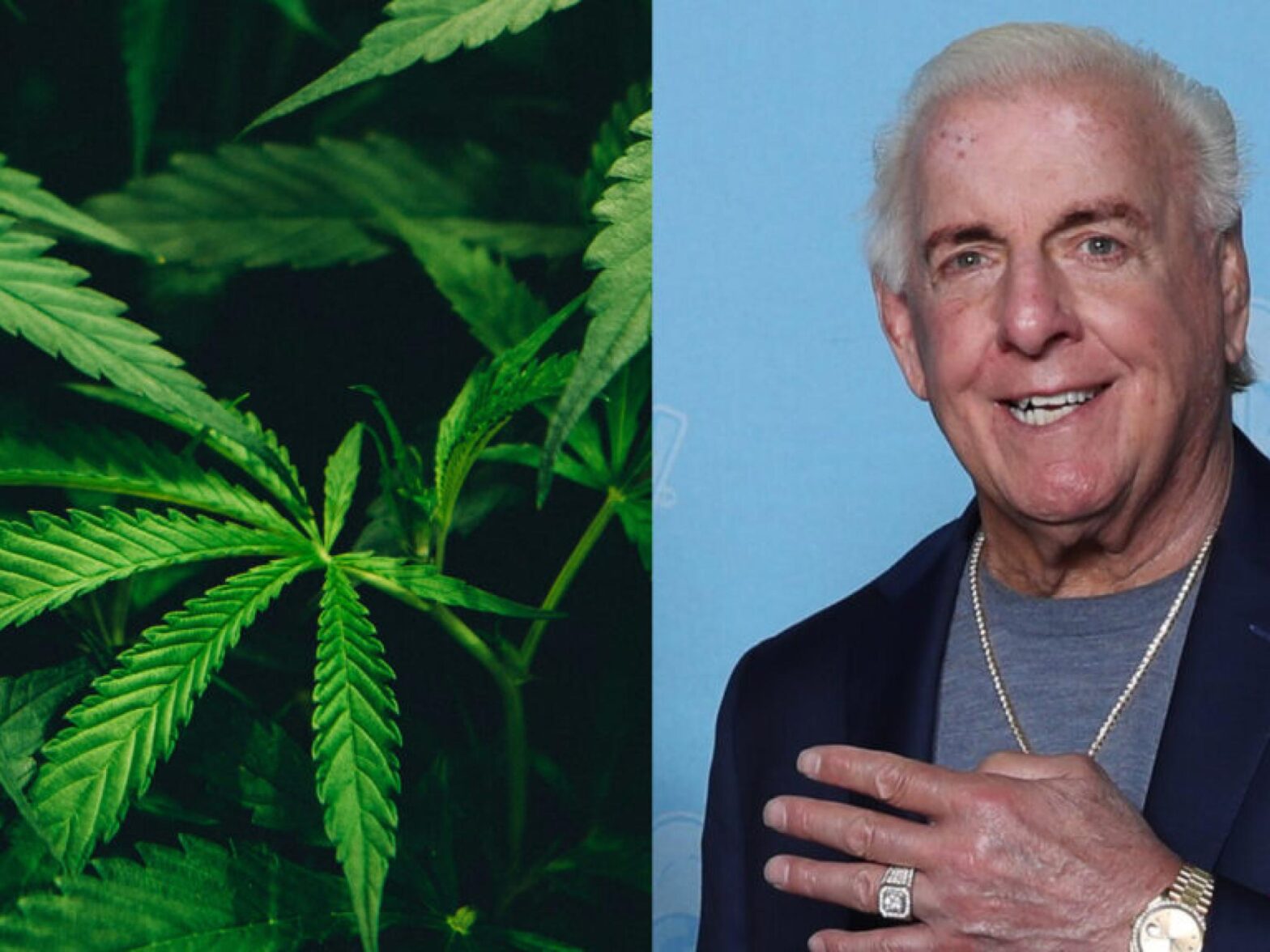

Ric Flair Drip is hitting the shelves in California in partnership with Green Dragon Cannabis and he’ll make a special in-store appearance to personally connect with fans and to celebrate cannabis culture on 4/20, says parent company Carma HoldCo in…

U.S. stocks were lower, with the Dow Jones index falling over 50 points on Wednesday. Shares of United Airlines Holdings, Inc. (NASDAQ:UAL) rose sharply during Wednesday’s session after the company reported better-than-expected first-quarter financial results. Revenue of $12.539 billion topped…

A major Ethereum (CRYPTO: ETH) investor reportedly lost over $4.5 million in two failed attempts to leverage the cryptocurrency. The investor then sold $33 million worth of ETH to settle the debt. What Happened: According to the Lookonchain report, the…