U.S. stocks were lower, with the Dow Jones index falling over 50 points on Wednesday. Shares of United Airlines Holdings, Inc. (NASDAQ:UAL) rose sharply during Wednesday’s session after the company reported better-than-expected first-quarter financial results. Revenue of $12.539 billion topped…

A major Ethereum (CRYPTO: ETH) investor reportedly lost over $4.5 million in two failed attempts to leverage the cryptocurrency. The investor then sold $33 million worth of ETH to settle the debt. What Happened: According to the Lookonchain report, the…

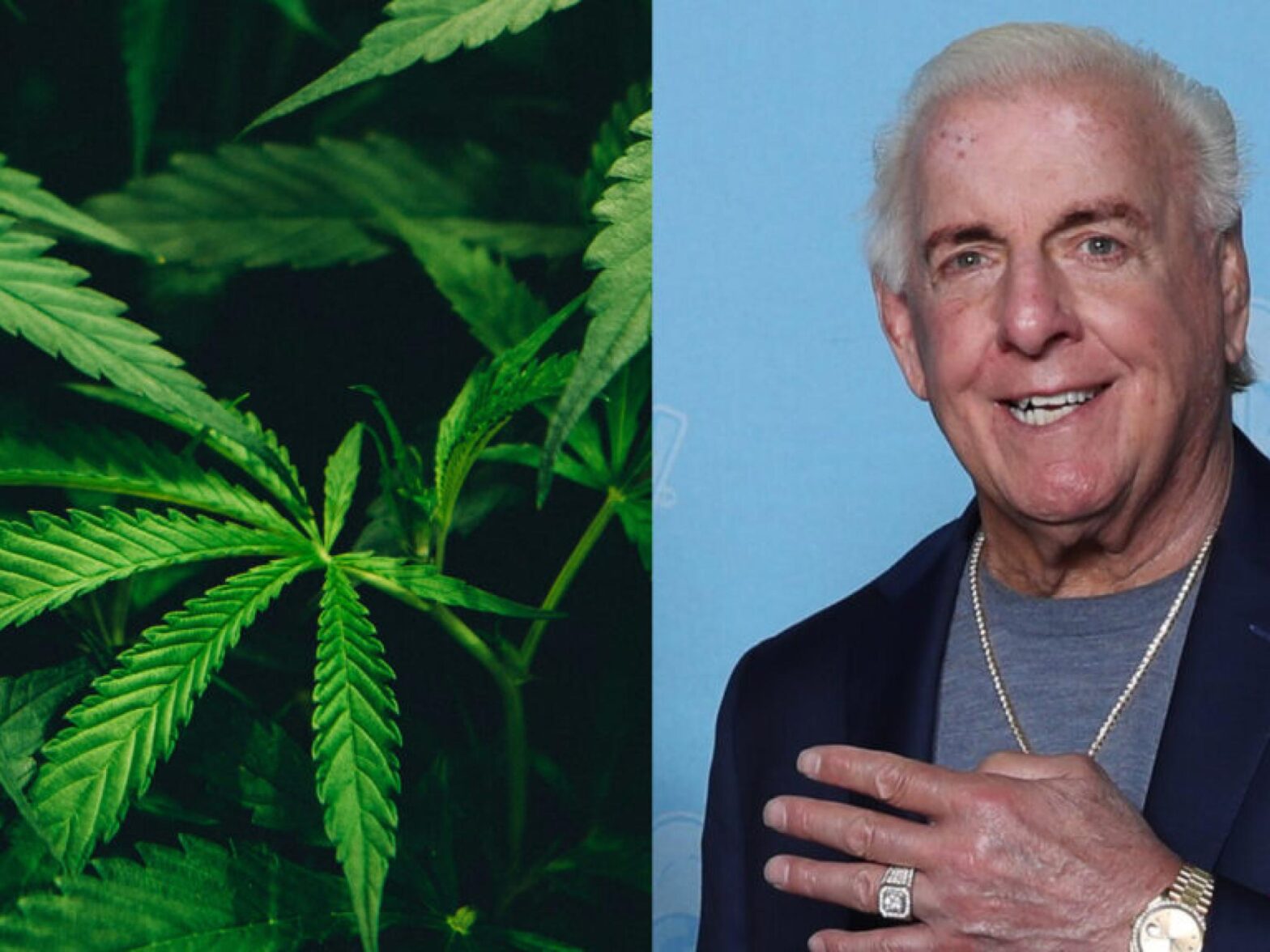

Cannabis industry's leading hiring platform Vangst has acquired CannabizTemp, the temporary staffing division of CannabizTeam. What Happened The company said on Friday the acquisition was 50% cash and 50% stock and is the first acquisition in the cannabis human resources…

Grayscale CEO Michael Sonnenshein on Friday shared plans for the company’s Bitcoin exchange-traded fund (ETF), the Grayscale Bitcoin Trust (OTC:GBTC), to eventually reduce its management fees. What Happened: Currently, GBTC charges the highest fees among all U.S. spot Bitcoin ETFs…

Shares of Ecolab Inc (NYSE:ECL) were rising in early trading on Wednesday. The downside risk to the company’s earnings seems “relatively benign,” given its business model and strategy, according to Piper Sandler. The Ecolab Analyst: Charles Neivert initiated coverage of…